Flooding can cause extensive damage to your home and belongings, leaving homeowners overwhelmed with cleanup and repairs. Navigating the flood insurance claims process can be daunting, especially if it’s your first time dealing with significant damage. Whether preparing ahead of time or recovering from a recent flood, understanding how to handle your insurance claim is essential for reducing your financial burden and speeding up your recovery.

Here are the top five insurance tips every homeowner should follow to maximize their coverage after a flood.

1. Understand Your Flood Insurance Policy

Before flooding occurs, it’s crucial to understand the terms of your flood insurance policy fully. Standard homeowners insurance policies do not cover flood damage, meaning most homeowners will need a separate flood insurance plan, often purchased through the National Flood Insurance Program (NFIP) or private insurers.

Key Areas to Review:

- Coverage limits: Make sure you know how much coverage you have for structural damage and personal property. Some policies may only cover the building, leaving your personal belongings unprotected.

- Deductibles: Understand the deductible for both structural damage and personal property. A higher deductible can mean lower premiums, but more out-of-pocket costs when filing a claim.

- Exclusions: Be aware of what’s not covered under your policy, such as outdoor structures or expensive personal items like jewelry or electronics.

Proactive Steps:

- Review your policy annually: This is especially important if you’ve made home improvements or added valuable belongings that may require extra coverage and sharing sensitive information.

- Purchase flood insurance even if you’re not in a flood zone: Many floods occur in low- to moderate-risk areas, so consider flood insurance even if it’s not mandatory.

Pro Tip: Contact your insurance provider if you’re unsure about your coverage. Don’t wait until after a flood to find out!

2. Document the Damage Immediately

After a flood, thorough documentation is crucial for a successful flood insurance claim. The more evidence you can provide, the better your chances of getting the compensation you deserve.

Steps to Take:

- Photograph and video everything: Capture detailed images of all damage, including structural issues like flooded walls and ruined personal items like furniture and appliances.

- Create a detailed inventory: List all damaged or lost items, noting their value, purchase date, and any receipts or records you have.

- Save receipts for temporary repairs: If you need to make immediate repairs, such as tarping a roof or boarding up windows, keep all receipts. These expenses may be reimbursed by your insurance.

Best Practices:

- Don’t discard damaged items before documenting them: Wait until the insurance adjuster has had a chance to inspect everything. Even seemingly minor items can add up in your claim.

- Timestamp your documentation: Use your phone’s timestamp feature when photographing damage to provide clear proof of when the flood occurred.

Pro Tip: Backup your photos and videos in the cloud to ensure they don’t get lost.

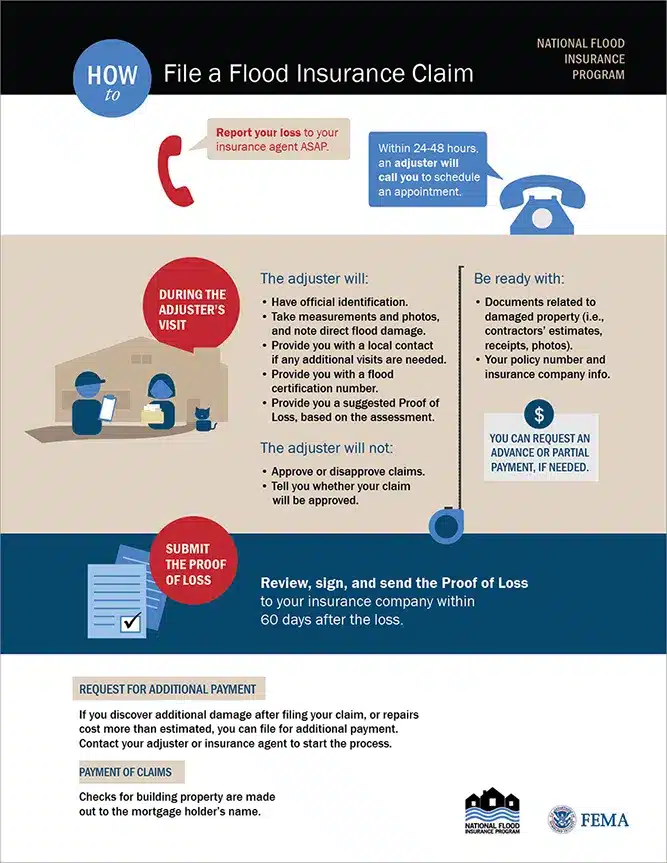

3. Contact Your Insurance Company ASAP

Once you’ve documented the damage, it’s important to file your flood insurance claim as soon as possible. Most policies have specific deadlines, so filing promptly helps prevent delays.

Key Steps:

File your claim quickly: Contact your insurance agent or insurance company as soon as the flood has subsided and it’s safe to assess the damage.

Request an adjuster visit: An insurance adjuster will need to inspect the damage. The sooner this visit happens, the faster your claim will be processed.

Maintain open communication: Stay in touch with your insurance company throughout the process. Ensure they have all the documents they need and follow up regularly for updates.

Additional Tips:

Ask about temporary housing: Some policies cover the cost of temporary lodging if your home is uninhabitable. You can also check the relevant information on a gov website for more guidance.

Keep a record of all communications: Document every interaction with your insurance provider, including emails, phone calls, and visits.

Pro Tip: Log all dates and details of your communication with your insurance company to keep track of your claim’s progress.

4. Maximize Your Payout by Negotiating

The first settlement offer from your insurance company might not fully cover your repair costs. Knowing how to negotiate your insurance payout can make a significant difference.

Tips for Negotiating:

- Get multiple estimates: Obtain quotes from several contractors for repairs. If the initial settlement offer is too low, provide these estimates as evidence.

- Present detailed documentation: Share any additional documentation that supports your claim, such as expert opinions, contractor estimates, or detailed descriptions of the damage.

- Consider hiring an independent adjuster: If you believe the insurance company’s adjuster underestimated the damage, an independent adjuster can provide a second opinion regarding the cost of repairs.

- Don’t rush into settling: While you may want to start repairs quickly, take the time to review the initial offer and request adjustments if necessary to cover the total cost of repairs.

- Request a breakdown: If the payout seems low, ask your insurance provider for a detailed explanation of the settlement amount and what was included or excluded.

Pro Tip: Independent adjusters often work on a contingency basis, meaning they only get paid if you receive a higher settlement.

5. Know When to Get Professional Help

If the flood damage is extensive, or if you feel overwhelmed by the insurance process, don’t hesitate to get professional help. This could involve hiring a public adjuster, a contractor, or a flood restoration company.

Options for Professional Assistance:

- Public adjusters: Public adjusters work for homeowners, not the insurance company. They help maximize your claim and negotiate on your behalf, often securing higher payouts.

- Flood restoration professionals: After severe flooding, mold growth and water damage can pose long-term risks. Hiring a professional flood restoration service ensures thorough water extraction and mold remediation.

- Licensed contractors: For repairs, always hire licensed, reputable contractors who have experience with flood damage.

- Get multiple estimates: Always get more than one quote for repairs to avoid overpaying. These estimates can also help you negotiate a higher settlement.

- Verify credentials: Check that any public adjusters or contractors you hire are properly licensed and insured. Read reviews and ask for references to avoid scams.

Pro Tip: Flood restoration professionals often work directly with insurance companies and can help you navigate the claims process.

Hold onto Damaged Materials and Repair Receipts

After a flood, retaining damaged materials such as drywall and keeping receipts for repairs are essential steps in the claims process. Holding onto items like drywall, flooring samples, and any other significant materials can provide tangible proof of your loss. These items offer concrete evidence of the extent of the damage and can help your insurance adjuster assess your claim more accurately. By preserving samples, you reinforce your case and demonstrate the impact of the flood on your property.

Additionally, maintaining a well-organized collection of repair receipts is crucial. These documents not only support your claim but also establish a clear record of expenses incurred during recovery. Insurance companies often require proof of repairs to finalize claims, so keeping all receipts related to repairs and replacements is vital for ensuring you receive the compensation you deserve. Remember, every detail counts when navigating the claims process.

Conclusion

Flood damage can be devastating, but knowing how to navigate the insurance claim process after floodwaters can save you time, money, and stress. By understanding your policy, documenting damage thoroughly, and negotiating for a fair payout, you can ensure your home is restored as quickly as possible.

When it’s time to clean up, Bargain Dumpster is here to help with fast, affordable dumpster rentals. We make post-flood debris removal easy, so you can focus on what matters most—getting your home back to normal.

Ready to Estimate Your Benefits or Costs

As a homeowner dealing with flood damage, estimating the cost of repairs and understanding your flood insurance coverage is crucial to avoiding costly repairs. Start by reviewing your policy to determine the extent of your coverage. This includes understanding what types of damage are covered and any limits that may apply. Having a clear picture of your policy will help you assess whether you have adequate coverage to address the damage caused by flooding.

Once you have a firm grasp of your coverage, gather estimates for the cost of repairs. This should include obtaining quotes from contractors for structural repairs, as well as any necessary replacements for damaged belongings. By preparing this information, you can better navigate the claims process and ensure that you are adequately compensated for the flood damage. Remember, documenting every aspect of the damage and repair costs will strengthen your claim and help you receive the benefits you need to recover.

Should You Pursue Legal Advice?

In certain situations, seeking legal advice can be beneficial when navigating the complexities of flood damage claims. If your insurance provider denies your claim or offers a settlement that you believe is insufficient, consulting with an attorney may be a wise step. They can help you understand your rights and evaluate whether your insurance company is acting within the bounds of your policy. Legal counsel can provide clarity and guidance, especially if you encounter disputes regarding coverage or compensation.

Additionally, if a third party is involved—such as a contractor who may have contributed to the damage—an attorney can assist in establishing liability and pursuing necessary compensation. Legal advice from an official government organization can also prove invaluable in cases of potential bad faith claims against your insurance provider. It’s important to weigh the costs of legal representation against the potential benefits in order to make an informed decision. Ultimately, having legal support can safeguard your interests and ensure that you are treated fairly throughout the claims process.